As we continue to grapple with the Coronavirus pandemic, it seems the looming question on everyone’s mind and across every news headline is, when can we expect a cure for COVID-19? While doctors and scientists work around the clock to bring us medical solutions, our team at SAM feels compelled to do our part to help cure another chronic illness – the elusive Behavior Gap that has infected the common investor and led to emotional decisions for decades.

In the investor world, there is an intense amount of focus on market volatility as a key contributor to poor investor performance, especially now, during a pandemic while societal and economic unrest pulls at the strings of the stock market. However, less attention is paid to a far more pressing reason for widespread losses: The Behavior Gap, a term coined by the New York Times sketch artist and former financial planner Carl Richards. While extremely common, most individuals don’t even know they are part of it, and/or understand what it is. So, what is the Behavior Gap?

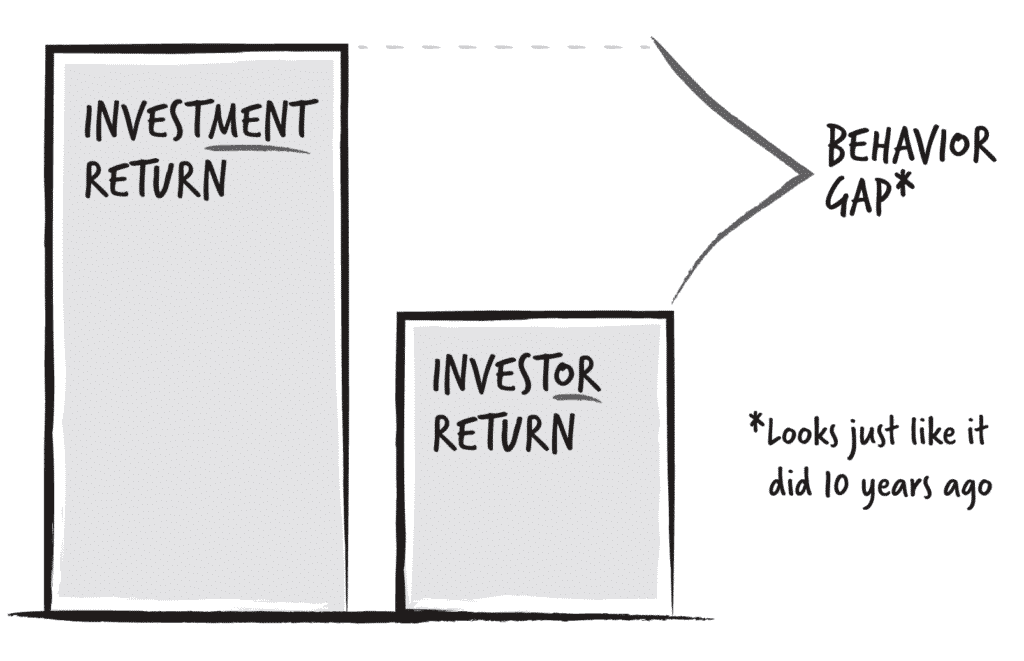

As Jonathan describes in his book, Your Rich Life: A Human Approach to Investment and Building the Wealth of Your Dreams, “The Behavior Gap describes the difference between the higher returns that investors might potentially earn, and the lower returns they actually do earn because of their own behavior. This generally occurs due to emotional reactions causing shorter holding periods, which often results in buying at highs (euphoric moments) and selling at lows (moments of despair or extreme pessimism about the future).”

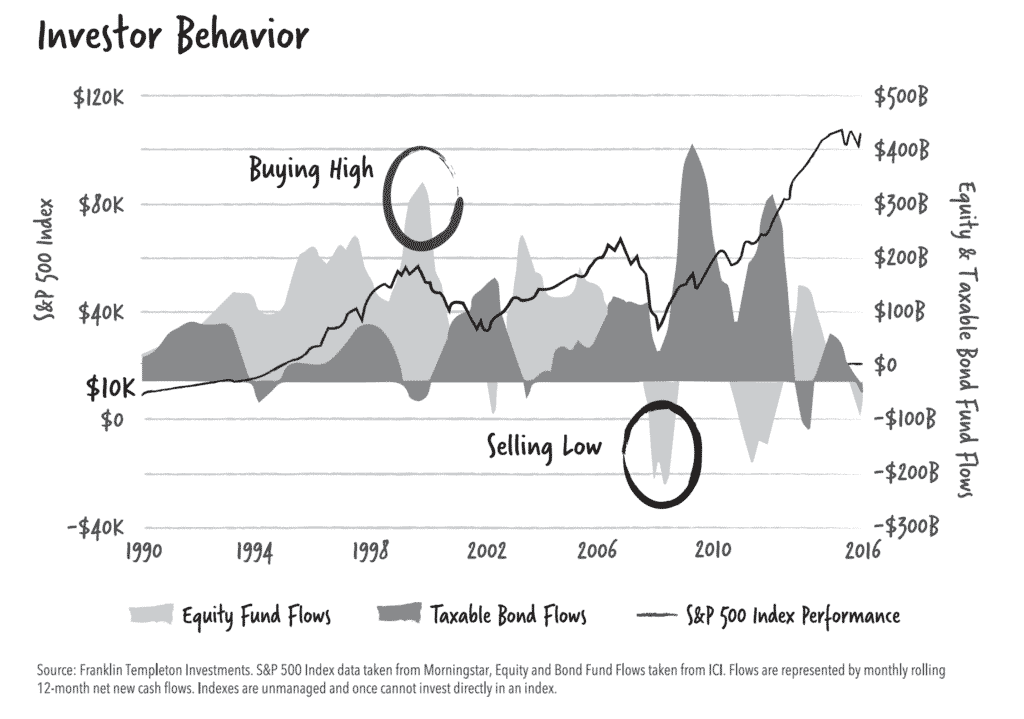

Many investors earn lower returns not because of the investments they choose but because of the way they interact with these investments. If these investors behaved differently while still owning the same investments, they would experience better results. Looking at historical data we can see this pattern play out quite consistently.

The Behavior Gap describes the difference between the higher returns that investors might potentially earn, and the lower returns they actually do earn because of their own behavior. Over a 20-year period from 1996 through 2015, the S&P 500 yielded a return 8.2%. Over the same time period, as per the latest DALBAR study, the average dollar invested in U.S. equity mutual funds returned 4.7%.The gap between 8.2% and 4.7% is largely explained by the proverbial trend of bad buy and sell decisions. As Jonathan noted, investors collectively tend to buy high and sell low.

In comparing historic and current events we can see the pattern of emotional decision making repeat anytime volatility increases. With 86% of the trading days this year (as of June 12, 2020) having experienced a daily movement of +/- 2-6% of S&P 500 prices, it may seem logical that investors reported this week having over $5 trillion dollars parked in money markets. However, this demonstrates our ancestral brains working against us in fight or flight mode, which decreases our ability to create long-term sustainable wealth.

As industry professionals, we see the effects of the behavior gap on a regular basis. Even investors with a diversified long-term portfolio mindset find themselves tempted by behavioral biases and the urge to react to market fluctuations. The reality is the behavior gap and its financial consequences are rooted in human nature, which means they aren’t likely to be cured anytime soon. However, the power lies within you to define the right mindset, further your investor education, and stay the course of a diversified long-term investment strategy.

The job of a responsible fiduciary isn’t to outperform the market, but to do everything in our power to minimize the Behavior Gap and help clients achieve their multi-generational goals. After many years in the lab of personal finance, our team at SAM prescribes a remedy of equal parts:

- Knowledge – the power of financial literacy & planning

- Indifference – EQ > IQ

- Transparency – establishing trust and confidence!

Knowledge – The Power of Financial Literacy & Planning

The phrase “knowledge is power” is often attributed to Francis Bacon, but has been echoed by the likes of Thomas Jefferson, Elon Musk and notably referenced in the old testament of The Bible, “A wise man is strong, yea a man of knowledge encreaseth strength.”

During the 2007-2009 Great Recession I brazenly posed the question to Jamie Dimon, CEO of JP Morgan, at a Town Hall meeting during my tenure with the firm “how much time do you think people spent researching the mortgages taken on their homes vs. the televisions they purchased for them?” Of course, this was a rhetorical question; but therein my question lied an even more important question—why do people invest so much time and money to acquire the education and skills to earn money, and comparatively so little to acquire the knowledge to properly manage it?

Why do people invest so much time and money to acquire the education and skills to earn money, and comparatively so little to acquire the knowledge to properly manage it?

It is a shame that we don’t learn basic financial literacy as part of our high school curricula. This means that most people learn to manage (or mismanage) their wealth through experience, which boils down to trial and error, leading to problems like the Behavior Gap.

Whether you’re an investor or future investor seeking to improve your financial literacy and make more informed financial decisions, start by understanding where your finances currently stand.

You’d be surprised how often we have very successful people come into our office (once upon a time) who, admittedly, know very little about their overall finance picture. Even more rare are those that have their own investor philosophy or know how to design an investment strategy that aligns with their personal and financial goals.

You should work with a planning advisor to review an x-ray of your financial situation – starting with your balance sheet and cash flow needs –and assess your current versus projected financial requirements. Then, consider your personal goals and aspirations, and reverse engineer those goals to create a financial strategy that harmonizes (in equal measure) your needs, ability and willingness.

Building a financial philosophy that aligns to your goals and aspirations enables you to sleep at night knowing your money is really working for you, without having to worry about short-term activity. We have found the best way to achieve this is by establishing a diversified long-term portfolio of assets that you are willing to stick with for at least ten years, through both ups and downs. Staying the course is the surest way to build wealth but building the resilience to stay the course requires us to get emotionally fit!

Indifference – EQ > IQ

The word indifference—as it relates to investor behavior— means having the resilience to overcome our human tendency to make emotional “in the moment” decisions.

Our human tendency, to good and bad news, is to overreact. This tendency is further augmented during times of personal uncertainty: when nearing retirement, for example, or during a global pandemic. Yet, as the Behavior Gap illustrates, emotions work against us when it comes to investing. We are innately susceptible to the opinions of others, the temptation of the “next hot investment”, and the fear of the unknown, especially when market volatility is reflecting social or economic uproar, such as we have experienced with the COVID-19 pandemic.

“Having a certain kind of temperament is more important than brains. You need to keep raw irrational emotion under control.” Charlie Munger

Charlie Munger (Warren Buffet’s long-time partner) is notably regarded for his literature on the mindset of indifference, which encourages investors to remain indifferent to the crowd when your strategy or investments seem contradictory. In the book The Complete Investor, Ted Griffin explores Munger’s 13 attributes that make up “the right stuff” of a successful investor. When it comes to controlling dysfunctional emotional urges, Munger emphasizes the importance of building Sound Temperament. He writes, “Having a certain kind of temperament is more important than brains. You need to keep raw irrational emotion under control.”

Ray Dalio, author of Principles: Life & Work echoes the importance of equipping yourself with the right information and minimizing harmful emotions in order to make good decisions. Principle 5.1 of his book cites harmful emotions as the single biggest contributor to bad decision making, and suggests ongoing learning is one of the most important tools to increase effectiveness.

No matter how much you aspire to be a financial superhero, we’re all human, which means we are all affected by behavioral biases. Safeguarding yourself means getting equipped with the tools, knowledge and advice to build emotional intelligence and reduce the pressures of finance-related stress.

Transparency – Establishing Trust and Confidence!

Whether you’re managing your own investment portfolio or working with an advisor to help structure and steward your investments, knowing what you own and why is critical in developing the trust needed to stay the course for long-term wealth. This connection to trust helps build the confidence and emotional resilience to hold on during times of volatility or downturn.

“Knowing what you own and why is critical to developing the emotional resilience needed to stay the course for long-term wealth.”

When it comes to finding a financial coach to help you manage your wealth, the decision is as personal as it is financial. Every relationship should be built on a foundation of ongoing transparency and trust, be it in business, friendship or marriage. An advisor relationship is akin to having a behavioral coach in your corner to align your goals and lifestyle with a money philosophy that makes sense to you and helps take the emotions out of investing when temptation arises.

Though human nature itself isn’t curable, the power lies within you to avoid falling victim to the Behavior Gap. A healthy dose (and balance!) of Knowledge, Indifference, and Transparency will prove invaluable in your pursuit of financial wellbeing. Next time you feel tempted to change course, take stock of your tool K.I.T. before making any decisions!

At SAM our dedicated team of professionals consider it our fiduciary duty to provide clients with the highest standard of care and service in the advisory world. To learn more about how we may help you, get in touch with a SAM advisor today.