It was quite a year. At the start of the year, inflation was at 6.5%. Nearly everyone was predicting a recession. As we went through the year, the Federal Reserve was raising rates at one of the fastest paces ever. We had three major bank failures (which if measured by assets, nearly surpassed the failures in 2009), a continuation of one major war (Ukraine/Russia), and a new one (Israel/Gaza). There was much to be pessimistic about.

And yet, markets weren’t just resilient, they were jubilant. For the year, the S&P 500 was up 26.3%, while international markets1 were up 15%. After a difficult third quarter, almost everything rebounded in the fourth quarter: the S&P 500 finished up 11.7%, while international markets were up 10.1%. And unlike where we were in the third quarter, where most of the total S&P 500 index return was due to the 7 largest stocks (now nicknamed the “magnificent 7”), performance broadened out to more companies. Small capitalization companies, as defined by the Russell 2000, were up 14%, and the Russell 2000 value did even better, up 15.3%. Small caps also beat large caps internationally with the MSCI world small cap index up 12.1%.

What was especially surprising was the magnitude of the rally in the bond market. Ten-year treasuries declined to under 3.8% in late December from a peak of 5% in mid-October—a huge move for under just over two months. Because of this move, the Bloomberg Aggregate Bond index increased 6.8% in the quarter.

As a reminder, last quarter I wrote:

Some are asking if they should take their money out of the market. We’ve discussed in these letters quite a few times how difficult it is to time the market. As I mentioned in my last letter, very few thought the S&P 500 would be up double digits this year. I think Ben Carlson said it best that “The Big Short by Michael Lewis has lost investors more money than the last 3 bear markets combined.”2 What he meant by that is those “contrarians” that always see a bear market coming will eventually be right but will miss out on so many gains along the way that it doesn’t pay to try…I’ve been in the investment business for 30 years, and I haven’t met anyone who can consistently time the market.

I admit that I had no idea what was going to happen in the fourth quarter, so I’m not taking a victory lap. My point here is that being a skeptic often sounds smarter than optimistically believing that the future will be better than the present. We don’t know what will happen in the short term, so we try to prepare for what can go wrong and let the upside from owning risk assets like equities take care of itself. We know owning equities takes patience and discipline to deal with the inevitable volatility, so we do our utmost to combat behavioral risk—both yours and ours.

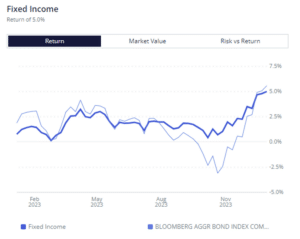

Part of how we try to combat behavioral risk for some clients is to advise them to own some amount of fixed income and cash. Over decades, the equity market has had higher returns, but with higher volatility. Philosophically for us, fixed income and cash are intended to provide psychological safety and the capacity to weather volatility in the equity market.

That’s one of the reasons why we tend to take less risk in the fixed income portion of the portfolio. The adjoining chart shows the performance of the fixed income portfolio of one sample client (most clients saw similar results) in 2023. As you can see, our fixed income returns were much less volatile than the fixed income market,3 while providing very similar returns.4 By having the psychological safety to weather any storm, we believe that clients will maximize their returns over the long-term.

Source: Satovsky Asset Management

Getting the right structure in place is critical. Every year is volatile, but this election year is likely to have some heightened volatility. Please reach out to us if there is any change in your personal situation so we can recalibrate together to make sure you are on the right path, and that you are never a forced seller during adverse times.

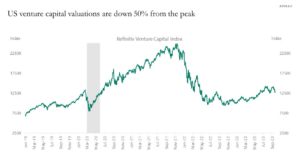

Not everything was good in 2023. IPO markets are still largely closed, and venture capital hasn’t rebounded like public markets (see adjoining chart).5 There is also a lot of capital waiting to be invested in almost all private markets. But overall, most asset classes were strong in the fourth quarter.

Source: Bloomberg, Apollo Chief Economist

One piece of sad investment news was the death of Charlie Munger on November 28, less than two months before he was to celebrate his 100th birthday. Charlie, Warren Buffett’s right-hand person at Berkshire Hathaway for 60 years, was often credited for changing Berkshire’s investment style to one of buying “wonderful companies at fair prices” from buying “good companies at cheap prices.” Much of the investment success at Berkshire was due to Charlie in addition to Buffett.

In addition to his investment acumen, however, Charlie will be missed for his charm and wit. I had the pleasure of meeting Charlie in person just once when he came to my office (at a previous firm) with the management of Costco. At the time in his high 80s, he was as sharp mentally as anyone in the room (from attending the Berkshire Hathaway annual meeting, I can honestly say this continued into his late 90s) and made his points with humor and acerbic wit. Charlie has so many famous quips (often slightly off-color), that any list would do it injustice. But here are a few I saw quoted recently:6

1. Go to bed smarter than when you woke up.

2. I think that every time you see the word EBITDA, you should substitute the words “bullshit earnings.”7

3. If you don’t get this elementary, but mildly unnatural, mathematics of elementary probability into your repertoire, then you go through a long life like a one-legged man in an ass-kicking contest.

4. Remember that reputation and integrity are your most valuable assets—and can be lost in a heartbeat.

5. People calculate too much and think too little.

6. Develop into a lifelong self-learner through voracious reading; cultivate curiosity and strive to become a little wiser every day.

7. You need patience, discipline, and agility to take losses and adversity without going crazy.

8. Knowing that you don’t know is more useful than being brilliant.

9. Acquire worldly wisdom and adjust your behavior accordingly. If your new behavior gives you a little temporary unpopularity with your peer group then to hell with them.

10. It’s waiting that helps you as an investor and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.

He will definitely be missed.

Carbon offsets

There were a couple of stories I came across on carbon offsets that I thought would be interesting to share. This one could have easily gone into the following section (Interesting stories for the quarter), but due to the seriousness of climate change, I decided to make it its own section.

Many companies are saying that they plan to be carbon neutral by some date in the future. How do they do that, when every company pollutes? In theory, the company could release some carbon, but then plant a tree which absorbs carbon from the atmosphere. If it plants enough trees, it can offset its carbon pollution, and—voila—they are carbon neutral.

That sounds simple and understandable. But what happens if I know a forest is going to be cut down, and I buy it and let it stand? Theoretically, preventing a forest from being cut down has a similar value (carbon-wise) to planting a new forest. And instead of purchasing the forest themselves, what if the company pays someone else who already owns a forest not to cut it down? In other words, what if they just purchase the carbon credit that the forest owner has by just not cutting their forest? When companies speak of carbon offsets, they are most likely speaking about this type of offset. The difficulty here is how to determine how much of the forest you purchased would have been cut (i.e. the baseline carbon amount), to figure out how much of a carbon credit they should have to sell in the first place.

The baseline is often set by a reference forest nearby that is being cut down, and the owner of the credit references the other forest’s pace of deforestation to determine how much credit they should get for not cutting down their own forest. But you can see the issue here: what happens if the reference forest ends up being cut down more slowly than expected? There’s a perverse incentive to cut down the reference forest faster so that it looks like you are saving more carbon by not cutting down your first forest!

There was a wild story of these perverse incentives that was chronicled in a recent New Yorker article.8 A company called South Pole tried to sell carbon offsets by claiming it was saving a large forest from being cut down. But as it turns out, not only did much of the money disappear, but much of the carbon offsets were “fake” (i.e. they sold too many credits) in large part because the reference forest didn’t cut down as many trees as they thought. For the planet, this is a good thing. For the accounting of carbon offsets, it’s shady. Don’t trust people claiming to be carbon neutral just yet!

Interesting stories from the quarter

Piggybacking on the carbon offset discussion above, here’s a hilarious story on cow burps.9 When cows burp they release carbon. But if you could get them to burp less, by changing their feed to a special low-burp diet, there’s a reduction in carbon. According to Bloomberg, Canada is trying to encourage farmers to reduce emissions by granting them credits that could be sold as carbon offsets to other businesses. In order to do that, you need the baseline of what would have happened without the change in diet. Matt Levine notes:

You sell the burping reductions to like an oil-sands company to offset their emissions. Drilling up oil causes carbon emissions, and cows burping cause carbon emissions, but, through the magic of accounting, getting the cows to burp less offsets the oil drillers’ carbon emissions.

What are the chances that there will be some sort of cow burp accounting scandal, where ranchers claim excessive credits by manipulating the inputs into the formulas?

I think it’s bound to happen.

There were so many other good stories for the quarter, it was hard to cut them for this letter.

Two famous fraudsters got convicted this quarter. As a follow-up to our third quarter 2022 letter, Trevor Milton, founder of EV truck manufacturer Nikola10 was convicted for fraudulently claiming Nikola’s truck was ready to go, when in reality he had to roll it downhill to look like it could drive. In addition, Sam Bankman-Fried (or SBF as he is known), founder of crypto trading company Alameda Research and crypto exchange FTX, was convicted of fraud for inappropriately (and without disclosure) borrowing and losing client deposits at Alameda rather than keeping them segregated. Caroline Ellison, the CEO of Alameda (and on again/off again girlfriend of SBF), testified that as crypto prices declined in 2022, at SBF’s request, she prepared seven different balance sheets to show one of its lenders, and SBF chose to send alternative seven. There’s only one accepted way to present balance sheets, so if you are contemplating choosing alternative number seven, you should know already there was a problem.11

Last quarter I wrote about the movie Dumb Money saying if you are ever tempted to do something that sounds too good to be true, watch the movie to jar you out of it. Well, it seems like the UK Financial Conduct Authority is worried that people will take the opposite message from the movie, because they felt the need to run an ad at the beginning of UK showings of Dumb Money:

The voiceover starts to talk about a ‘once-in-a-lifetime opportunity to make some serious money’. It is then revealed that the anonymous tipster is in fact typing in an online forum, before the advert ends with the FCA’s call to action: ‘Don’t Get Played’. The FCA is supporting the main advert with digital screens in cinema foyers, and geo-targeted display ads – tailored to people who have visited cinemas, alongside ads in contextual locations online, where the target audience research investments. This makes the connection with audiences both before and after the film and reminds them what they should do before they invest.12

I’m not sure what to make of that other than behavioral risk has little to no bounds. Maybe I should have suggested not to watch the movie?

Lastly, a story that only has one word for it: Chutzpah.13 SEC rules require that any company must report any security breach publicly at most four days after being made aware of the breach. A ransomware group named AlphV broke into the systems of fintech company MeridianLink asking for ransom. When MeridianLink didn’t pay the ransom after the four days, AlphV reported the breach to the SEC, claiming that MeridianLink refused to disclose this security breach to its investors, even though they were the ones who hacked them in the first place! I’ll be looking to see whether they ever claim the whistleblower reward for SEC reporting violations.

Thanks to all of you for your trust in our partnership.