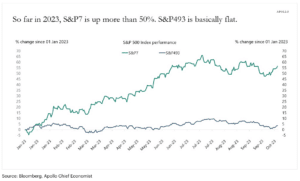

Markets had a difficult third quarter. The S&P 500 finished down 3.3%, while international markets1 were down 4.1%. Year to date, the S&P 500 is up 13.1%, but the headline number masks the underlying market dynamics: all of that performance was driven by the top 7 market cap companies in the index: Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia, and Tesla. The “S&P 493”2 is basically flat. The outperformance of a few stocks is not so unusual, but the largest market capitalization stocks being the few is. What that means is that although the overall market looks like it’s having a terrific year, most stocks are not.

Some are asking if they should take their money out of the market. We’ve discussed in these letters quite a few times how difficult it is to time the market. As I mentioned in my last letter, very few thought the S&P500 would be up double digits this year. I think Ben Carlson said it best that “The Big Short by Michael Lewis has lost investors more money than the last 3 bear markets combined.”3 What he meant by that is those “contrarians” that always see a bear market coming will eventually be right but will miss out on so many gains along the way that it doesn’t pay to try. Carlson also quotes Jeff Bezos who correctly said, “contrarians are usually wrong.” I’ve been in the investment business for 30 years, and I haven’t met anyone who can consistently time the market.

Mid last month, I travelled to Charlotte to attend an investor conference run by Dimensional Funds. As you know, our portfolios own some exposure to various funds run by Dimensional.

Dimensional Funds started with two premises:

- Focus on research-based strategies, including work done by three different nobel laureate economists, Eugene Fama, Ken French, and Robert Merton. Research showed that the only persistent signals for outperformance in stocks were those companies that were small, cheap and profitable.

- Execute in a way that’s superior to others.

Both were on display at the conference.

All three Nobel laureates made appearances at the conference. Fama and French discussed how, when looking for persistent factors that lead to outperformance, the default assumption should be that any outperformance was due to randomness and not to any enduring signal. Indeed, they conjectured that artificial intelligence will only create more false positives by looking at historical data. According to Fama and French, the only factors that have proven over the long run that they improve performance are those companies that were small, cheap and profitable. That’s what Dimensional does, and that’s where we tilt our portfolios.

Another interesting research note was on private equity. Merton discussed his research on the accuracy of the perception that private equity has lower volatility. He posed a simple question—what if we take the S&P, but only marked it to market every week instead of every day? What he found was that the correlation to the actual S&P was only 0.48 and the volatility was lower by 54%.4 If we duplicate the experiment by marking the S&P every two weeks, the correlation was .25 and the volatility was lower by almost 75%. Private equity marks their books materially less frequently than that! Merton’s conclusion is that the much of the touted private equity diversification and lower volatility is due to them marking their books much less frequently than public equity.

There was also a lot of discussion on execution. Dimensional spends a lot of resources not only trying to figure out what to buy, but also how to buy it. Since they aren’t an index fund, they aren’t required to own anything at any time. This gives them the flexibility to decide when to purchase and sell securities taking into account tax considerations, short-term momentum, timing and other indicators. Indeed, the story was corroborated by a contact at a Wall Street foreign exchange desk, who said that Dimensional is one of the few firms they deal with where they don’t make money.

I left the conference confident in the process and execution. Throughout SAM, we also think a lot about process and execution. And when we can learn from companies in our orbit, we know that we, and you our partners, will be better off for it.

Interesting stories from the quarter.

Be careful of funds touting extremely high annualized results.5 Titan Global Capital Management was fined by the SEC for hyping annualized returns as high as 2,700%. The problem was that it was only up 21% over three weeks, but that annualized to 2,700%. I’m pretty sure real investors never saw those results.

Anybody remember the Fyre Festival? Billy McFarland spent four years in prison when he sold expensive tickets to a “luxury” Caribbean music festival which ended up having battered tents, no bathrooms, and cheese sandwiches for food. According to news reports6 McFarland is at it again with a Fyre Festival II, which supposedly sold 100 tickets at $499 apiece. Per the festival’s site, the one-day event will take place in an as yet undetermined location in the Caribbean. I’d say use that money (and perhaps a bit more) and buy yourself some Taylor Swift tickets instead. Or book your own Caribbean vacation.

Ryan Cohen is a meme stock star. While he made most of his money by founding pet food retailer Chewy, he is now more well known for being Chairman (and now also CEO) of GameStop during the time when it became a Reddit favorite. So, when Cohen purchased a near 10% stake in Bed Bath and Beyond in early 20227, the stock shot up 34% in one day. By August, with fundamentals deteriorating, the shares were back below where Cohen had purchased them. But then Cohen re-disclosed that he owned the exact same number of shares he purchased earlier in the year, the stock went up over 50%, and he sold all his shares. A few people sued him for securities fraud due, in part, to a tweet a few days before with a moon emoji at the end. According to the judge, “online communities understand the smiley moon emoji to mean ‘take it to the moon,’” in effect telling his followers to purchase the stock. Can an emoji be securities fraud? I don’t know. But I think the better question is, why would you be purchasing a stock based on a moon (or any other) emoji?

On the topic of memes and Ryan Cohen, I have read the reviews (although I haven’t seen yet) of Dumb Money, the movie on the GameStop craze. If you ever get tempted by something that’s too good to be true, I recommend you watch the movie to jar you back to reality.

One last note: we have been researching some private investment opportunities that we believe have the potential to enhance the risk/return of your portfolios. These investments are generally illiquid, have fewer guardrails and less public information compared to public market investments. Generally, they are available to investors with over five million dollars of investable assets (not including a primary residence). If you are interested in those opportunities, please contact your SAM financial advisor.

Thanks to all of you for your trust in our partnership.

Avi and the SAM team