I started the last quarterly letter stating that a common theme in these letters over the last year has been that it’s very hard to time the market. I want to continue that theme here. Despite everyone “knowing” that recession is coming, the S&P finished the 4 th quarter up 7.6%. International markets did even better, with the MSCI World ex US index up 16.2%. For the year, the S&P was still down 18.1% (-14.3% for the MSCI World ex US).

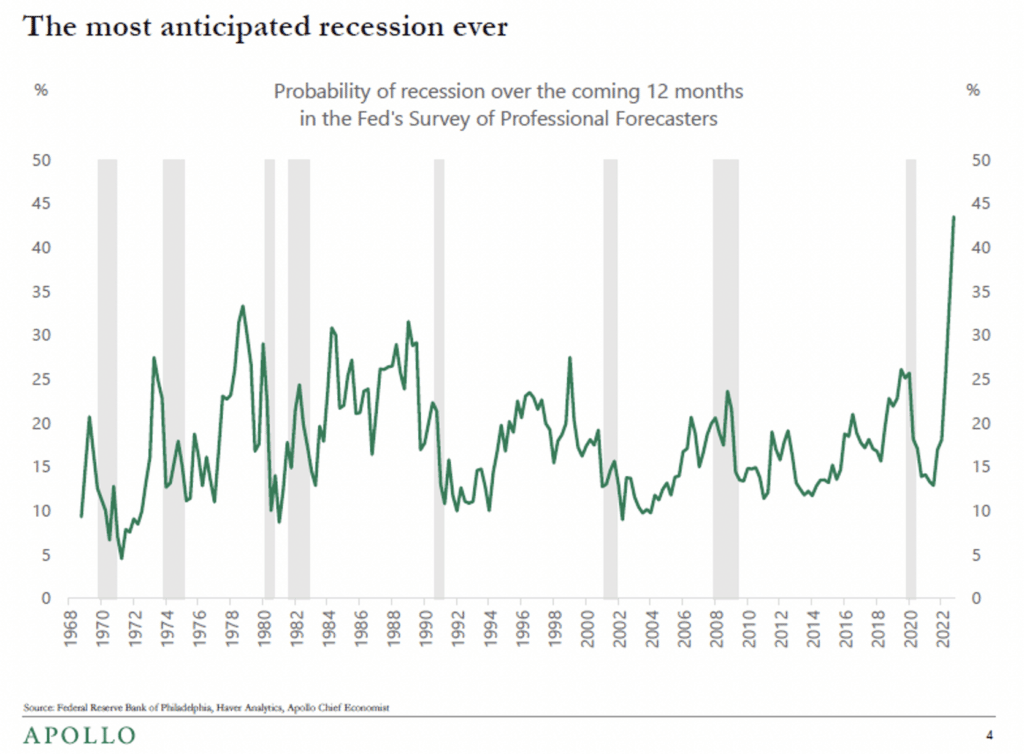

One of the most interesting articles I read this quarter was a recent Wall Street Journal article1 which showed that the big banks’ earnings estimates at the beginning of 2022 for the full year for the S&P 500 turned out to be almost spot on (assuming earnings come in as expected for the fourth quarter, which we won’t know for sure for another month and a half). They haven’t been that accurate since 1995. Despite getting the earnings right, the prognosticators got the market totally wrong, as most forecasters predicted the market to rise in the mid-high single digit range. But the market was lower because the price to earnings ratio declined, in part due to the Fed raising interest rates and the fear of recession. Indeed, I’ve read multiple publications which said that this is the most anticipated recession ever. Well, here’s one data series that empirically shows it:

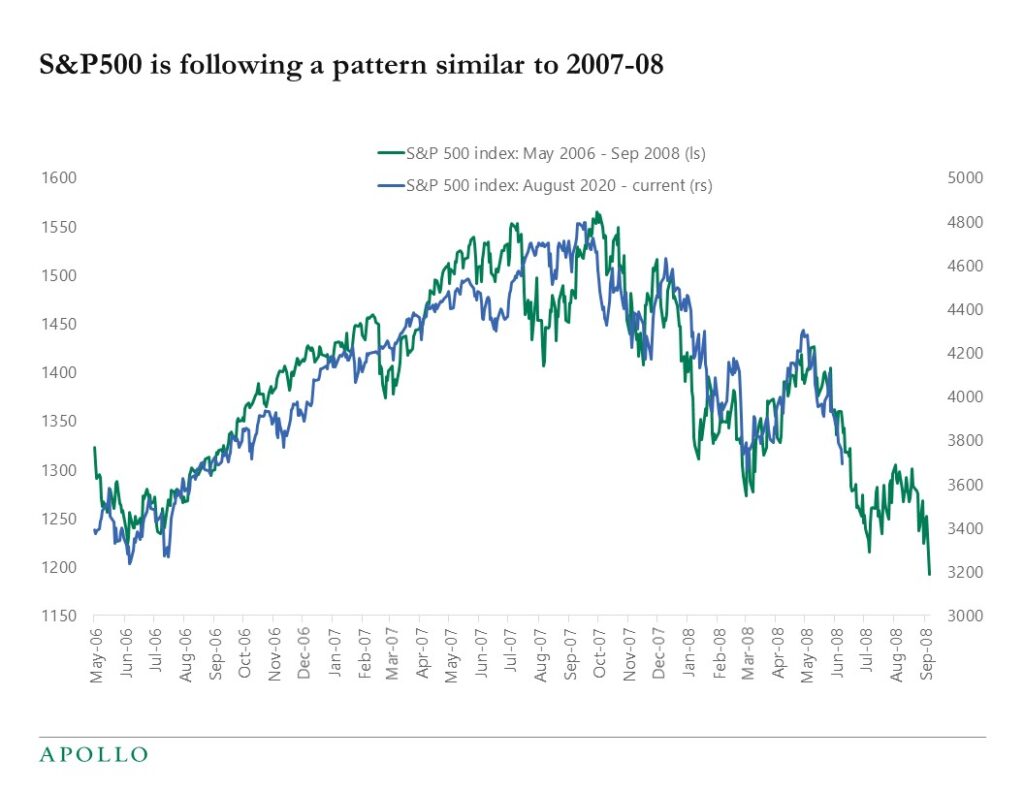

So what does that mean? The market is forward looking, so if everyone expects a recession, at least some of it is already priced into stocks, especially with markets down mid-high double-digits last year. Whether it’s fully priced in depends on how severe the recession—if we have one—turns out to be. I’ve seen alarmists show a chart like this several times to show that we are at the precipice. It purportedly shows how the S&P is following a similar pattern to 2007/2008, with the implication that we are likely to drop severely in the coming months:

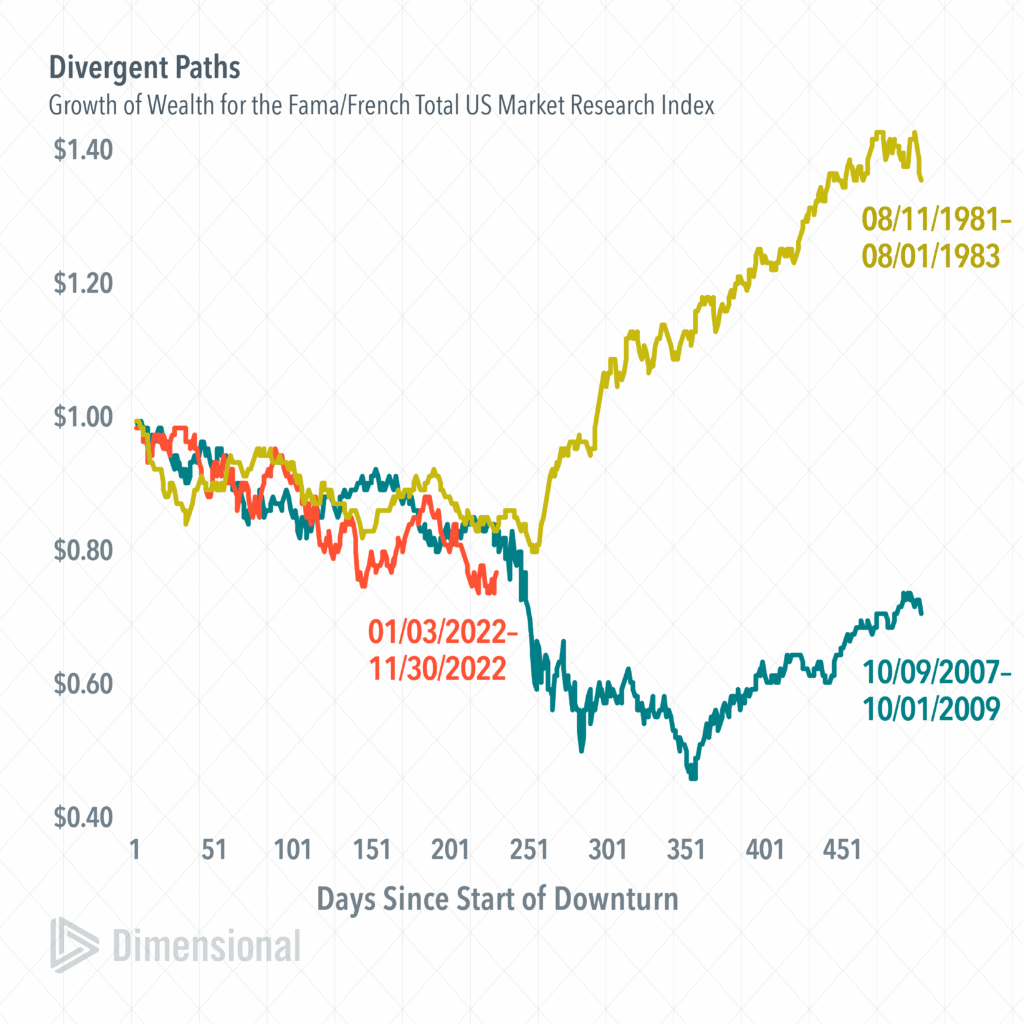

The problem with these charts is that every situation is different. This one, from Dimensional, shows that while the market looks like it’s tracking similar to 2007/2008, it also is tracking very similar to 1981-1983, right before a dramatic increase in the market. Which one is it? It will probably end up not looking like either of those.

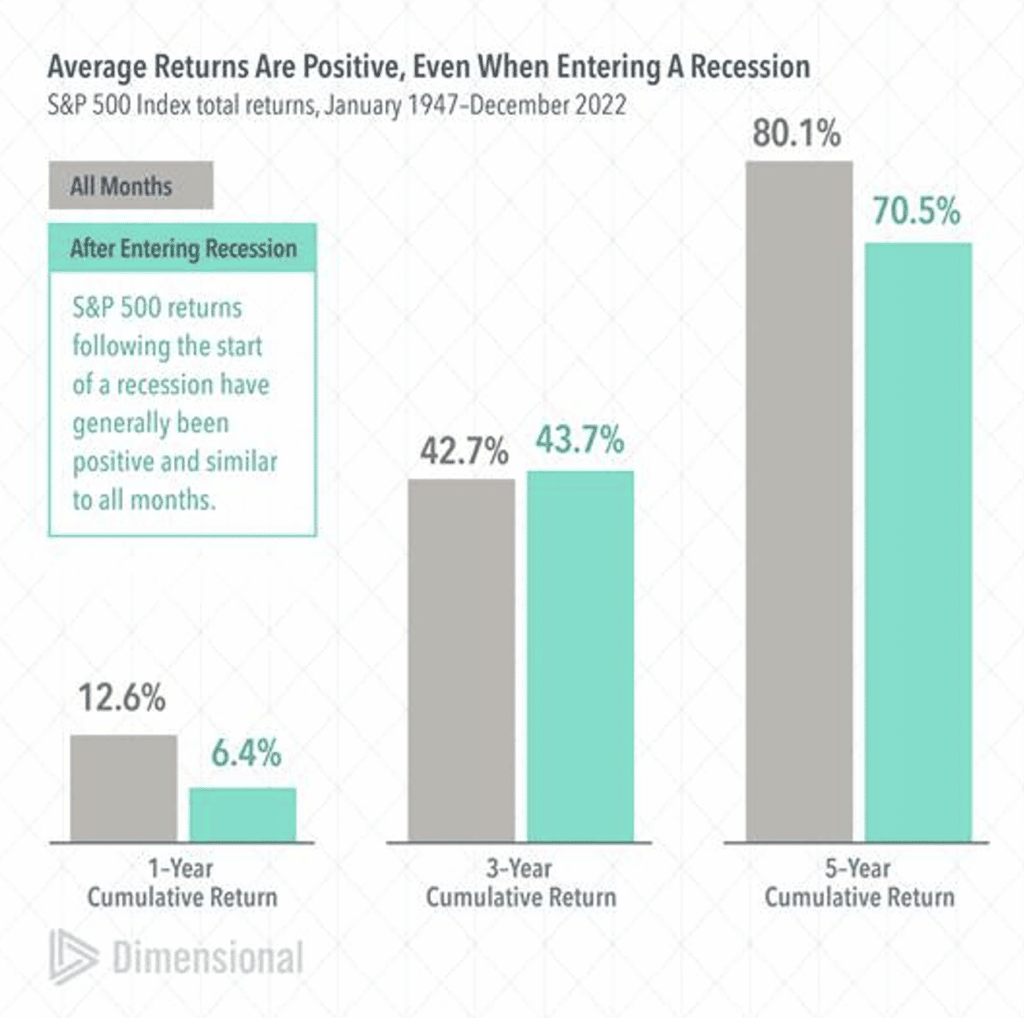

We discussed this in last quarter’s letter, but markets don’t necessarily move down during recessions. The chart below shows that while the market returns are better when there isn’t a recession, the returns are still positive during a recession. Why? Often, it’s because the market anticipated the recession prior to it happening and is already looking to the recovery when the recession is occurring. Another reason is that valuations are cheaper after the market has declined. According to Grandeur Peak (one of SAM’s outside fund managers), valuations of the companies they own (mostly international micro-cap companies) have never been this inexpensive in the history of the firm.

As is often the case, Howard Marks2 from Oaktree puts it best:

In late 2015, virtually the only question I got was “When will the first rate increase occur?” My answer was always the same: “Why do you care? If I say ‘February,’ what will you do? And if I later change my mind and say ‘May,’ what will you do differently? If everyone knows rates are about to rise, what difference does it make which month the process starts?” No one ever offered a convincing answer. Investors probably think asking such questions is part of behaving professionally, but I doubt they could explain why. The vast majority of investors can’t know for sure what macro events lie just ahead or how the markets will react to the things that do happen.

Since we all hear about the negatives every day, what, you might be asking, are some of the potential positives? The first is that inflation is already declining. As seen in the chart below, according to the official statistics, housing costs are still rising, but the data they use to calculate housing lags the true state of the economy, so expect that to roll over soon as well.

Inflation and core inflation are falling3 without the labor market weakening materially. I think the labor markets are key to understanding what will happen in the next year. Most companies have spent the last couple of years struggling to attract and retain people. With some notable high-growth tech stocks as exceptions, most companies are loath to let go of people. In addition, I also recently saw a Federal Reserve paper4 which argues that interest rate increases are now impacting the economy faster than it used to. That’s a good sign—it means that we are closer to the bottom. If this holds, according to Apollo Chief Economist Torsten Slok, “The bottom line is that the likelihood of a soft landing is rising.”

In my view, the biggest risk to the market is if inflation declines to something like 4%, but then stays sticky at that level, and the Fed decides it needs to slow down the economy even more to reach its 2% target. But at this point, the soft landing looks most probable to me.

It was a tough year for all of us, no doubt. Volatility on the downside is difficult to endure. So, I want to go back to Howard Marks5 again because his view of volatility is similar to mine:

I define risk as the probability of a bad outcome, and volatility is, at best, an indicator of the presence of risk. But volatility is not risk. That’s all I’m going to say on that subject…It’s essential to recognize that protection from volatility generally isn’t a free good. Reducing volatility for its own sake is a suboptimizing strategy: It should be presumed that favoring lower volatility assets and approaches will – all things being equal – lead to lower returns…Why do I recite all this? Because volatility is just a temporary phenomenon (assuming you survive it financially), and most investors shouldn’t attach as much importance to it as they seem to.

Indeed, Marks reminded me of a great story I had read a couple of years ago6:

A news item that has gotten a lot of attention recently concerned an internal performance review of Fidelity accounts to determine which type of investors received the best returns between 2003 and 2013. The customer account audit revealed that the best investors were either dead or inactive – the people who switched jobs and “forgot” about an old 401(k) leaving the current options in place, or the people who died and the assets were frozen while the estate handled the assets. (“Fidelity’s Best Investors Are Dead,” The Conservative Income Investor, April 8, 2020)

Volatility kills returns not because of the returns in down markets but because of what people do in response to the volatility. One of the ways people try to deal with volatility is to hide in private markets. I’ll have more to say about private markets in next quarter’s letter.

ESG

As most of you know, ESG is an acronym for Environmental, Social, and Governance. The idea behind ESG investing is usually one of two things (or both):

1. The investor feels that companies and customers will be more focused on ESG in the future, and therefore companies who focus on those factors will outperform.

2. The investor wants to align their investments with their values regardless of whether the returns are better or worse than the overall market.

SAM has done a lot of work on ESG and what we’ve found is that the company data isn’t robust so it’s very hard to effectively align the investments with clients’ values. And even when the data is available, often the E, S, and G conflict with each other.

I recently saw an article7 which highlights the problem. The author compares two funds, YALL and ESGU. According to the author:

YALL doesn’t come right out and call itself “anti ESG” but it’s easy to read between the lines of its prospectus, which says the fund intentionally excludes companies that have “emphasized politically left and/or liberal political activism and social agendas at the expense of maximizing shareholder returns.” Contrast that with ESGU, which seeks to “obtain exposure to large- and mid-cap U.S. stocks, tilting toward those with favorable environmental, social, and governance ratings.”

The author noted that despite the diametrically opposing mission, nine of the top 10 holdings in YALL are also in the pro-ESG ESGU fund. Tesla and Nvidia are in the top holdings of both, while other crossovers include Costco, Amgen, Danaher, Applied Materials, Prologis, Charles Schwab, and Mondelez.

SAM has only invested in one fund family’s ESG funds—those run by Dimensional. While not perfect, we feel like they do the best job of anyone we’ve researched of parsing through the data to come up with an environmentally focused fund. And we will only invest in ESG funds if clients specifically request them. If you are interested, please let us know.

Interesting stories from the quarter.

I recently received the following email:

Avi… you have been selected as one of the “Top 10 Finance Leaders of 2022.”

A brief biography of the featured leader, written from a business perspective in a 700-word article, which provides an overview of you and Satovsky Asset Management… for $ 1500 you will get two full-page profile in the magazine that will also include a headshot of the leader, a highresolution PDF of your profile, an HTML link with a backlink, a digital logo, a media or press release, and a digital certificate of recognition. I’d like to get started on the profiling process, but I need your signature on the contract order first.

Can I share the contract order to initiate the profiling process?

To which I responded:

Thank you for “selecting” me as a top 10 finance leader. As a “benefit” to my selection, I must pay you $1,500.

Did I get that right?

If you thought that was bad, look at this other email I received:

Hi Avi, The greatest investors of our lifetimes are allocating to Bitcoin. Ray Dalio, Paul Tudor Jones and Stanley Druckenmiller all own Bitcoin. But many people are still concerned about the volatility. That’s where Capriole steps in to manage Bitcoin cycles with autonomous algorithms that trade 24/7. Our objective is simple: outperform Bitcoin. And our strategies have been achieving that since 2019. We are seeking investors and seeders to help scale our capital based by 10- 50X over the coming months, as we see deep value in the market today. We also doubled our investment in the fund. Would you be free for a short call to discuss working together?

In my 3rd quarter 2021 letter, I warned you about things that look too good to be true. This fund’s custodians were now bankrupt FTX and Gemini, and Binance. I haven’t received any follow up emails recently.

But the most brazen (alleged) scam I’ve heard in a while was this one8. The SEC recently charged several people for their involvement in CoinDeal. CoinDeal claimed to own a unique blockchain technology that was on the verge of being sold for trillions of dollars (yes you read that right) to a group of reputable billionaire buyers9, but it required interim financial support until the sale transaction closed. While waiting for the close, the company gave all sorts of excuses for the delay in closing, including the involvement of foreign central banks and the United States Department of Homeland Security, the latest board meetings of the consortium of wealthy buyers, and the role of certain political figures. By June 2021, the payout table looked like this10:

I do feel sorry for the people who invested, and who are likely to have limited recovery. Always remember our 3rd quarter 2021 letter on Shiny New Objects.

And finally, I love this story as told by Matt Levine11:

I am just mad I didn’t think of the idea of “Bitcoin astrologer” first. Just saying or reading or typing those words, I think “oh right yes of course that’s gonna be lucrative.” But also this:

Maren Altman, a popular bitcoin and ether-focused astrologist, is suddenly a fallen star among some Twitter critics. A newly surfaced court document shows she received $30,000 in marketing payments from the crypto lender Celsius Network in the months before it declared bankruptcy.

Altman’s Twitter critics say she received the money to create favorable content about Celsius while the company was suffering cash flow issues, and they criticized her for being less than forthcoming about the payments.

I don’t know about you, but I am shocked that someone might have undermined the integrity of CREATING ASTROLOGY CONTENT ABOUT CRYPTO LENDERS by being less than forthcoming about accepting payments.

And with that, try to stay sane during crazy times! Thanks to all of you for your trust in our partnership.

Avi and the SAM team