A common theme in our letters over the last year has been that it’s very hard to time the market. In our last quarterly letter, while we acknowledged all the negative forces that could affect the market, we listed five things to be optimistic about. And indeed, the market (defined as the S&P 500 for expedience) started the quarter by rallying 9% in July, before falling 4% in August and another 9% in September. All in, the market declined a bit less than 5% for the quarter.

That’s obviously disappointing. But while 5% isn’t a disaster, because the market rose and then fell 13% in the last two months, if feels a lot worse than it was. That is a danger.

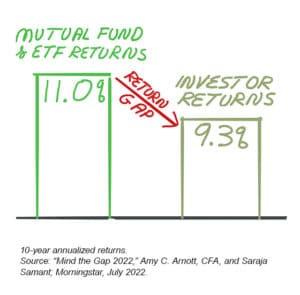

We have spoken at length about the behavior gap, whereby mutual fund investors underperform the underlying funds. The study we had been quoting was dated, but a new study from Morningstar just came out with data through 2021. Unfortunately, recent investor performance hasn’t improved.1

As you can see from the chart above, investors continue to underperform the underlying funds, and by an amount that hasn’t diminished over time. The study puts the reason for the gap squarely on buy and sell decisions by investors, which is often tied to volatility.

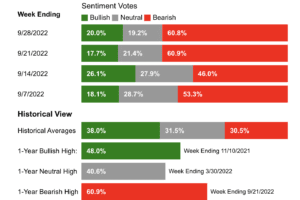

One of the reasons for that return gap is that it is common for people to become bearish after the market declines. Last quarter, we showed you the American Association of Individual Investors (AAII)2 sentiment survey which showed that investors were much more bearish than normal. Since then, it’s gotten worse.

The “experts” don’t know what will happen either. On the same day in July, a JP Morgan strategist said that that inflation had peaked, the Fed would pivot, and equities would rebound in the second half, while Morgan Stanley strategists said it was too early to expect the Fed to stop tightening even as fears of recession grow.3 Separately, the CEO of Goldman Sachs, David Solomon, was quoted as saying, “In my dialogue with CEOs operating big global businesses, they tell me that they continue to see persistent inflation in their supply chains. Our economists, meanwhile, say there are signs that inflation will move lower in the second half of the year. The answer in uncertain.”4 One investor even blamed inflation on millennials5, which seems like a bit of a stretch to me.

I really love this recent quote by Howard Marks6 :

When asked whether we’re heading toward a recession, my usual answer is that whenever we’re not in a recession, we’re heading toward one. The question is when. I believe we’ll always have cycles, which means recessions and recoveries will always lie ahead. Does the fact that there’s a recession ahead mean we should reduce our investments or alter our portfolio allocation? I don’t think so.”

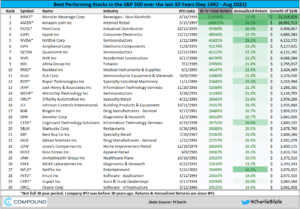

I wanted to address two other things in this letter that we haven’t addressed in the past. First, there are some who argue that all the innovation is in technology so why not just own technology? I recently saw this chart which listed the top 30 stocks ranked by total return over the last 30 years:7

One of the interesting things about the list is that only 11 of the 30 stocks (counting generously) are technology related. There are opportunities in many sectors, which is another reason why diversification is so beneficial.

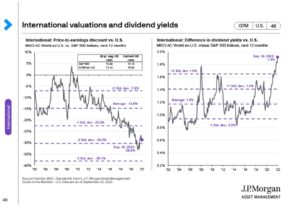

The second item I want to speak about is foreign markets. Regardless of which index you use, foreign markets have underperformed the US market by many hundreds of basis points per year over the last decade plus. This is driven by two factors. First, the valuations of international markets are now close to a low relative to the US and two standard deviations below the norm. Similarly, the difference in dividend yields is the highest in over 20 years.8

Second, the currencies of most major international markets have weakened dramatically versus the dollar. Therefore, returns in dollars have had a major currency headwind (see chart below)9:

What the chart below tells us is that stocks in countries with undervalued currencies tend to outperform over the next three years10:

We don’t know for sure what will happen, of course. But as GMO states, there are two ways to win here: valuations and currencies. I think the odds are good enough to keep a sizable allocation to foreign markets. Across portfolios, SAM clients have approximately one-third of their equity exposure (not including alternatives) in foreign markets.

Before we get to the interesting stories from the quarter, I wanted to give major kudos to Patagonia founder Yvon Chouinard. A few weeks ago, he transferred all his voting shares into a trust run by the family and his economic shares into a non-profit whose mission is to combat climate change. Patagonia has always been about the mission, and Chouinard literally put his money where his mouth is. You just don’t see that too often.

Like prior letters, here are a few interesting stories from the quarter.

Trevor Milton was the founder of Nikola11, an electric vehicle startup. He had boldly made claims that their new electric truck was a “fully functioning vehicle inside and outside,” and that the first prototype had “already” been built. To back his statement up, the company then released a video showing its truck in action. But Nikola didn’t actually have a working truck at the time; so the video released was of its truck rolling downhill, making it look like it could drive.

As if that wasn’t enough, Milton also claimed that the truck would have a drinking fountain using the water created by the truck’s hydrogen fuel cell, a novelty feature. Days later, however, Mr. Milton allegedly typed “can you drink water from a fuel cell” into an internet search. He was boasting about features that sounded good and then googling it after to see if they were possible.

Mr. Milton was just convicted for fraud.

Anthony Scaramucci’s SkyBridge Capital announced that Sam BankmanFried’s FTX Ventures would acquire 30% of SkyBridge. Scaramucci said that the FTX deal was a product of poor performance: “If I was doing super-well right now — our performance is mediocre, lackluster — who knows if we would be doing the transaction.”

But there might have been another motivation. As told by Matt Levine12, the FT article goes on:

Scaramucci said the transaction was decided over a two-hour lunch at a hotel in the Bahamas, where Bankman-Fried is based. Scaramucci was with his family on a Disney cruise that had docked in the islands. He said he proposed lunch to discuss the possibility of a partnership, as well as to avoid going to a water park with his children. What percentage of mergers and acquisitions do you think are driven by people trying to avoid spending time with their children?”

No comment necessary.

Finally, I came across an interesting paper which studied Wall Street sell-side analysts’ work habits.13 Since most sell-side analysts use Bloomberg, and log into Bloomberg in the morning and log out at night, the authors studied analysts’ accuracy of earnings estimates (and the number of reports that change earnings estimates) based on how long they work (when they log in and log out of Bloomberg every day), and how often they travel to meet companies (if they don’t log in at all). Their analysis showed that working more increased both the number of earnings changes and the accuracy of the earnings. Those that travel more issued fewer earnings estimate changes, but the estimates were more accurate. My conclusion from this? We should always be striving, as Jonathan likes to say, for more learning, growth, and fun. And it’s time for me to get back to work!

Thanks to all of you for your trust in our partnership.

Avi and the SAM team