“Hope is important because it can make the present moment less difficult to bear. If we believe that tomorrow will be better, we can bear a hardship today.” –Tich Nhat Hanh

What a difference three months can make. Back at our “Taking Stock” event in March, we provided historical data which, in total, presented a reasonably constructive picture of what was likely to happen. Unfortunately for all of us, that was just in time for a second quarter 16.7% drop in the US market, a 15.2% drop in international markets1 and the worst beginning to the year in over 40 years.

Forecasting the economy in the short run is incredibly difficult. As famed economist John Kenneth Galbraith once said, “The function of economic forecasting is to make astrology look respectable.”2 There are just too many moving parts, and too many unpredictable events, to get it right with any consistency. You might have heard the quip that prognosticators have “predicted eight of the last three recessions.”

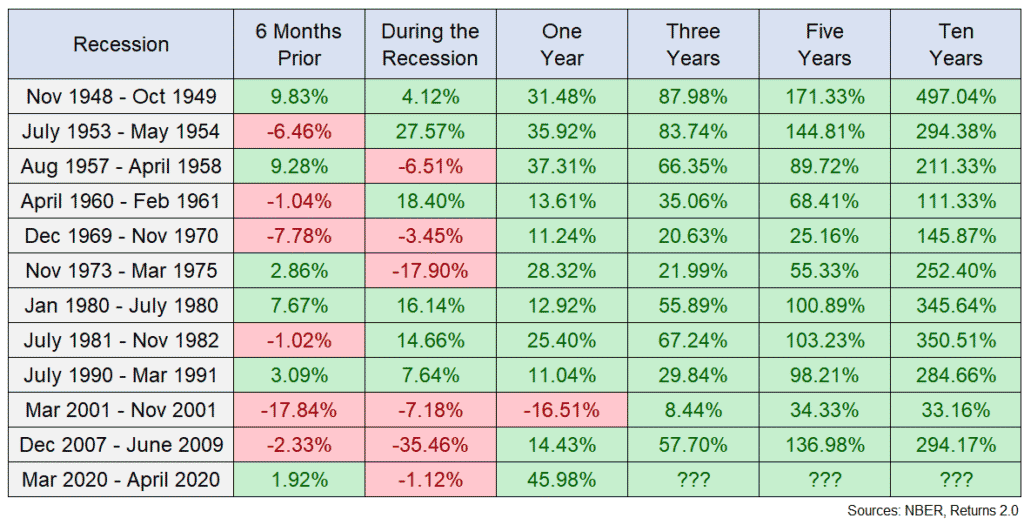

But even if you get the economy right, there’s no guarantee that you also get the market right in the short-term. The following chart, pulled together by Ben Carlson3, shows that the chances of the market rising prior or even during a recession are a toss-up at best.

His conclusion: “Timing of the economy is hard. Timing of the stock market is harder.”

There are two natural, but unhealthy, responses to the market decline. The first is to alter the long-term plan by selling equities and holding the proceeds in safer assets, such as cash.4 We’ve spoken to each of you about this in the past, but it’s hard enough to make one right call (when to sell), let alone two right calls (when to sell and when to get back in). Indeed, as Howard Marks, one of the founders of Oaktree, said in a recent letter, “…our business is full of people who got famous for being right once in a row.”5 And those are the “experts.”

The second is altering the plan to try to quickly make up what has been lost. In our 3q letter titled, “Beware of Shiny New Objects,” we talked about how easy it is to get sucked into a story of the next great thing. Since then, both Bitcoin and Ether have declined by over 60%. And that doesn’t include the myriad of crypto frauds6 or the total wipeouts (if you bought into Luna/TerraUSD or bought any crypto through Celsius).

Many NFTs7 have fared equally badly or worse. A recent article by Matt Levine8 told this story:

An NFT of the first tweet from Twitter Inc. co-founder Jack Dorsey sold in March 2021 for $2.9 million to Sina Estavi, the chief executive of Malaysia-based blockchain company Bridge Oracle. Earlier this year, Mr. Estavi put the NFT up for auction. He didn’t receive any bids above $14,000.

There was also another story in the same article about another NFT whose asking price was $25.5mm, while the highest bid at the time $210. Now that is a wide bid/ask spread! And while SPACs haven’t declined as much as that, one SPAC index was down 62% in late June.9 Some of this reminded me of NetZero, an early internet service provider, who in 1999, when it decided to give away its service for free, the stock jumped. I remember the CEO at the time quipped something to the nature of, “If I knew that would happen, I would have paid people to take the service.” We told you then, caveat emptor. As my friend and head of First Eagle Funds, Matt McLennan said recently, “If you are in a storm, at sea, the object is to get home safely not to break the speed record.”

Sure, there is plenty to be concerned about. You read about them every day in the paper. Indeed, we cannot guarantee that the market won’t decline even further. One client asked me during the quarter what I’m optimistic about. Here are my top few:

1. The market is already down 20%. Valuations are lower. That doesn’t mean it can’t go lower. But it does mean that I’m paying less for the same businesses, which means my risk is lower going forward. Indeed, even Warren Buffett has been allocating capital to equities in the last few months.

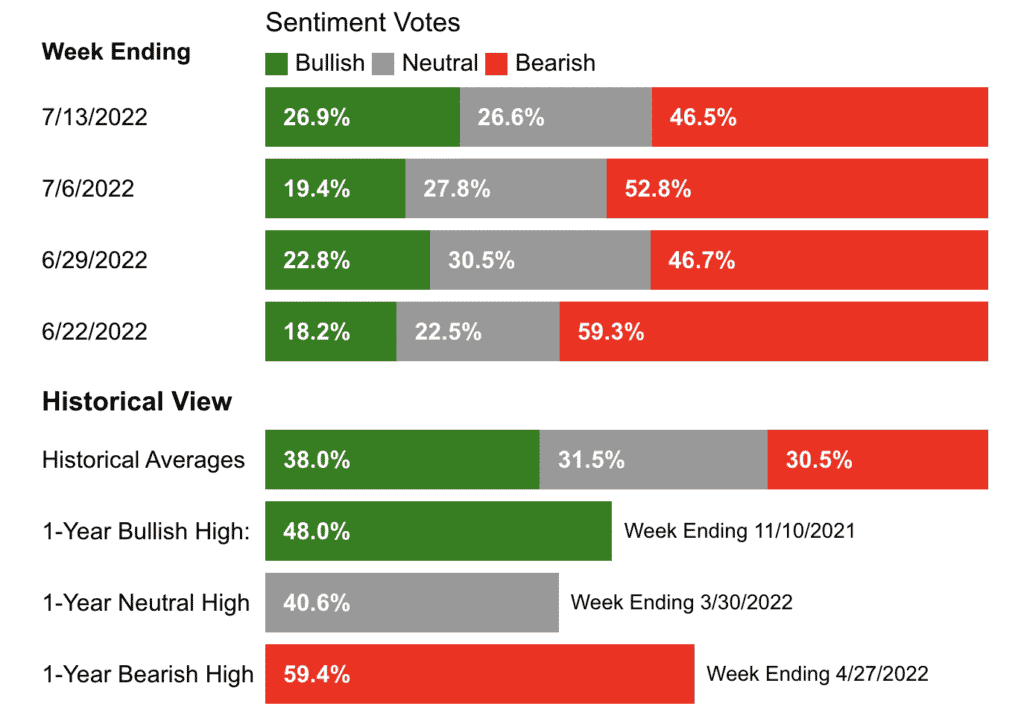

2. Sentiment is bad. Often the market bottoms when sentiment is at its worst because there’s nobody left to sell. According to the American Association of Individual Investors (AAII)10, sentiment is much more bearish than normal (see chart to below). In addition, approximately 55% of people believe we are already in a recession.11

3. Insiders are buying.12 Because many companies pay executives in stock, normally there are many more insider stock sales than purchases. But as recently as late May, there were more insider buys than sells. There are many reasons an executive would sell (diversification, large expense such as a home, etc.), but there’s only one reason to purchase—they think the stock will rise. This is the first time we’ve seen that since the depths of COVID.

4. Inflation will likely peak soon (if it hasn’t already). While the headline inflation numbers still look very bad, there are some positives. First, the Federal Reserve raising rates has already impacted economic activity, especially in the housing market.13 Second, almost all commodities have already declined – from the peak, oil is down 23%, copper is down 32%, and even wheat (despite the Ukrainian war) is down 19%. These will likely filter into the aggregate data in the coming months.

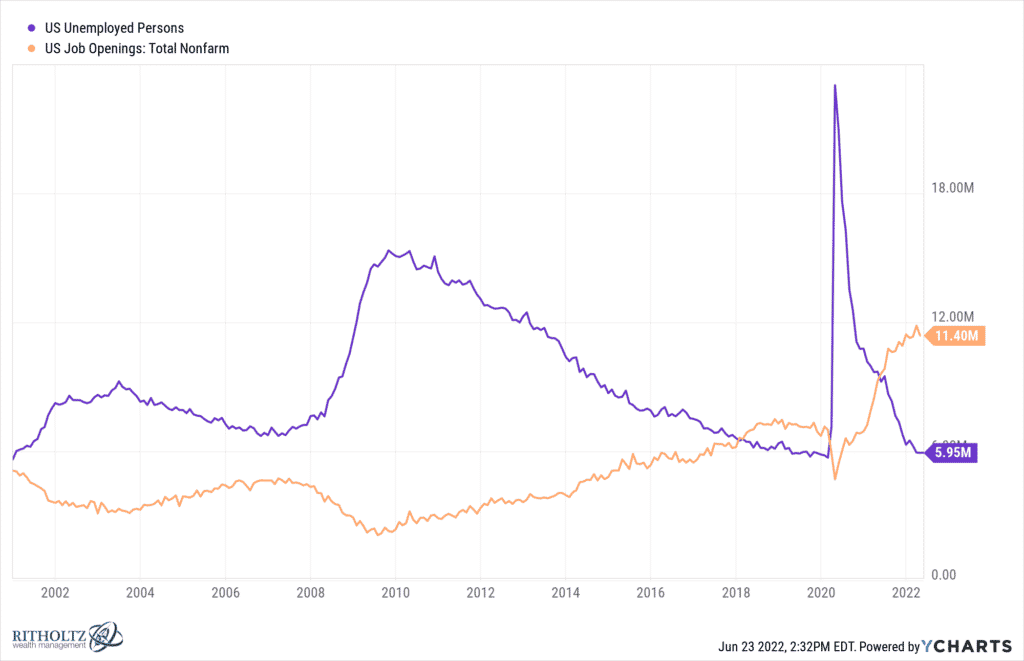

5. The economy still looks resilient. Below is a chart of US job openings (in orange) and unemployed people (in purple). Note that we are at a record for job openings and near a low in unemployment.14

What are we doing during this time? First and foremost, we are trying, as Charlie Munger said at the Berkshire conference this year, to “avoid stupid.” We will tie each other to the post to avoid the siren song if need be. Meanwhile, we are looking for opportunities in the markets that we can take advantage of, should they arise. We are aggressively taking advantage of the opportunity to tax loss harvest, so clients have a tax cushion going forward. We also have scheduled many meetings with clients to make sure the financial plan put in place still works for them. If you have any questions about anything related to your financial life, please reach out to us.

We understand it is small solace when losing money to know that you could have lost more money by doing something else. But as Ben Graham once said, “The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you need to go.” Once you create the plan, assuming the goals are the same, stick to it. And if you are in a position to take advantage when markets decline, your future self will thank you.

Avi and the SAM team