When I am asked what I worry about in the market, the answer usually is “nothing”, because everyone else in the market seems to spend an inordinate amount of time worrying, and so all of the relevant worries seem to be covered. My worries won’t have any impact except to detract from something much more useful, which is trying to make good long-term investment decisions.

Today’s worries include, but are not limited to, China’s regulatory actions, high and rising fuel and food prices, labor shortages, inflation or stagflation, the effect of Federal Reserve tapering, disrupted supply chains, potential default due the debt limit standoff and the ongoing dis-function and polarization in Washington. These are legitimate concerns and seem adequately reflected in the market, particularly so when stocks corrected in September. One thing I am pretty confident of is that twelve months from now those worries will have been replaced by a new set of worries1 (emphasis added).

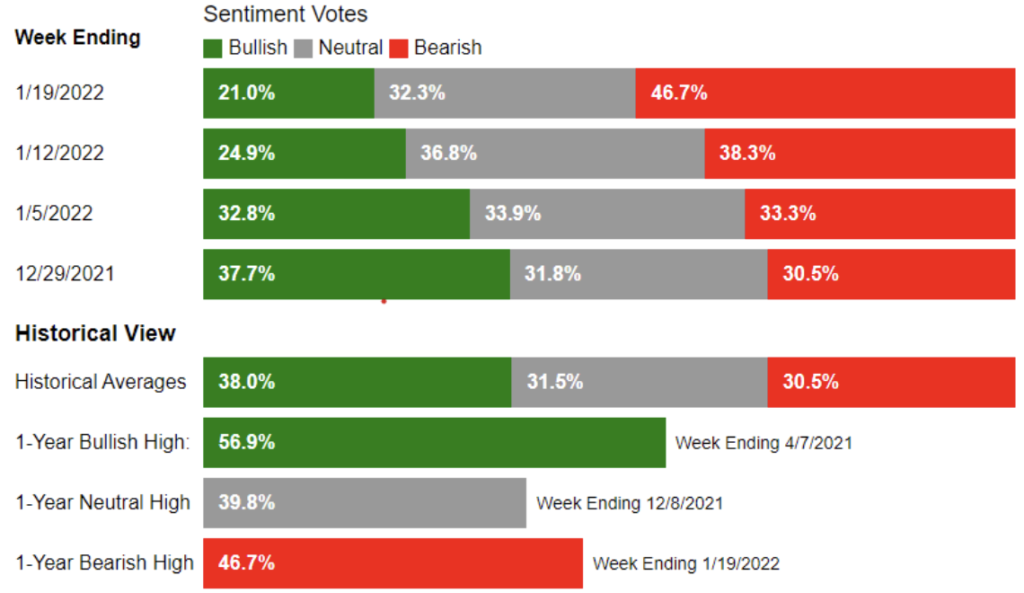

I’ll add another worry people have—the market is at an all-time high, and valuations are high, so what is the upside from here? Wait, what year is this? Indeed, SAM’s quarterly letter last year was titled, “Markets Are at All-Time Highs, Should I Invest?“ The answer for last year was clearly yes, and for the long-run is almost certainly yes as well. In the short run it is anybody’s guess2.

The business press definitely adds to the anxiety. But sentiment changes fast (sometimes in the same day and by the same person!). Here are different Barron’s headlines from October 8 through 19:

Jeremy Grantham is a good case study of exactly why we tell people to just ride through the cycles. He has been (very publicly) bearish on equities for almost (or maybe more than) a decade. We understand that hindsight is 20/20. But if you look at GMO’s 7-year asset class forecast from 2014 (which they have taken off their website4), you’ll see that they were wildly off actual returns. You’d have been much better off staying invested and riding the latest crash vs. staying in cash for those 6.5 years.

None of the data in the article is wrong. The issue is: is it possible to put a process in place to take advantage of that data? Without knowing exactly when a) the next market crash is going to happen, b) how long it’s going to be and c) how bad it’s going to be, you’re going to be better off staying invested. One of things I like to highlight is that you not only have to time the downturn right, but you also need to time when to get back into the market. How many times in one’s lifetime does the Red Sea part and tell us (in neon lights) to move forward exactly at the right time– twice?

In addition, I’d highlight that it’s not just when and how much the market will decline, but from what level. We know there’s going to be a large correction sometime, yes. But what if the market is up another 25% and then drops 15%. Is that our buy signal? The market will be higher than where we sold. People’s biases will have us anchor on where we originally sold, but is that right? We likely would have never gotten back in over the last decade…

There is clearly too much liquidity, and the Federal Reserve is slowly reducing liquidity in the system. This is definitely a risk. The liquidity has pushed valuations of some assets (crypto, NFTs) to crazy levels. We aren’t playing there. While we aren’t so naïve to think that the stock market will be unscathed if crypto really crashes (the crypto market is now $3 trillion), markets have done fine through crypto volatility before. Grantham is going to be right at some point. But all-in, I’d rather sit tight than try to time when he will be right.

It is for these reasons that we try to build diversified portfolios for people to survive through the inevitable ups and down. That doesn’t mean we won’t make some incremental changes to portfolios, but the core strategy of the accounts shouldn’t have wholesale changes.

We did make one tweak to some clients’ portfolios at the start of the year: for some clients that own fixed income, we swapped a portion of the fixed income exposure from the total bond market index (and/or munis, depending on the client) into short-term TIPS. This accomplishes two things. First, it gives us some protection in the fixed income portion of the portfolio should inflation remain high. The current breakeven rate of inflation is under 3% for the TIPS; right now inflation is more than twice that rate. Second, by shortening the duration, we are more protected from rising interest rates. Given how low interest rates are today, we felt we gave up very little for that extra protection.

I started last letter with some crazy stories from the third quarter, and so I thought I’d end this letter with a few new ones.

Recently one activist investor wrote a letter to the CEO of Macy’s7:

Macy’s share price is materially undervalued and requires urgent action to unlock value. We believe that by adopting the strategies discussed below, Macy’s would be worth more than $75 per share.

Macy’s should form partnerships with EV car companies (e.g. Tesla, Lucid or Rivian) to showcase their products on the ground floor of Macy’s 100 top landmark stores (e.g. Herald Square, Marshall Field, Union Square) and to use their massive parking footprint to build an EV charging network… We believe that direct association with EV companies will drive enormous traffic to Macy’s stores.

In addition, Macy’s should announce immediately that they are partnering with various Crypto platforms to allow digital payments. Macy’s can be one of the first major retailers to accept Crypto, joining companies like Starbucks and Whole Foods.

This might sound crazy—because it is8. It reminds me of 1999, when every company was adding “.com” to their corporate name to make the stock rise. Whatever “value” was created was gone after the bubble burst.

Cryptocurrencies currently are the closest equivalent to the wild west. In one case9, a number of celebrities, including Kim Kardashian, Floyd Mayweather Jr., and Paul Pierce, are being sued for allegedly leading investors into a “pump and dump” scam in a cryptocurrency named EthereumMax, by telling their millions of social-media followers to buy the cryptocurrency, only to sell when the price was inflated. Although this seems like a classic case of pump and dump, my question for the people who bought it is: did you really buy EthereumMax because Kim Kardashian told you to? What did you think EthereumMax was going to do, other than go up when Kim Kardashian posted about it and go down when she stopped? Caveat Emptor.

But my favorite recent story was this one10.

At roughly 1 a.m. Monday [November 15], [Ryan Cohen,] the 30-something Chewy co-founder, turned activist investor, turned GameStop chairman, tweeted “eew eew llams a evah I,” [author note: translate by reading backwards]

By midday, GameStop shares had climbed up as high as 4.2%…

GameStop is worth almost $10B and this tweet gets the stock to go up? I don’t even know what to say here. When Bloomberg columnist Matt Levine wrote about this article, his headline for the segment was: “This is how the stock market works now, you think I am joking but I never joke, everything is much stupider than my attempts to parody it.”11

Just for emphasis, we are not trying to play those games, but rather building diversified portfolios that will benefit with economic growth in the long run. To reiterate what we said in last quarter’s letter, we know it is scary sometimes to continue to stay invested when markets become more volatile. But if we maintain our focus on the long-term—and block out the noise—together we will succeed in reaching your family’s financial goals over multiple generations. Stocks are most often volatile in the short-term, but returns have been much smoother over the long-term. None of us need to tell you which is better to focus on for your health and wealth.

Thanks for your continued partnership with us,

Avi and the SAM team

1 https://millervalue.com/bill-miller-3q-2021-market-letter/

2 Adjoining chart is AAII members’ thoughts on stock market performance over the next six months. https://www.aaii.com/sentimentsurvey.

4 With a bit of googling, we found it via the link: https://www.scribd.com/document/233604513/GMO-7-Yr-Forecasts-June-14

5 https://www.oaktreecapital.com/insights/memo/selling-out

6 https://millervalue.com/bill-miller-3q-2021-market-letter/

7 https://nuorionadvisorsbusiness.files.wordpress.com/2021/11/letter-to-m-chairman-3.pdf

8 Although if it makes the stock go up, are CEOs violating their fiduciary duty to shareholders by not doing it? Let’s not get into that question!

9 Levine, Matt “EthereumMax” Bloomberg Opinion, Money Stuff, January 13, 2022

10 https://www.marketwatch.com/story/gamestop-stock-pops-thanks-to-ryan-cohens-small-wee-wee-11636997780. Perhaps tied with this one, for those who want to look it up: Levine, Matt “NFT Stuff: Other” Bloomberg Opinion, Money Stuff, January 6, 2022

11 Levine, Matt “This is how the stock market works now, you think I am joking but I never joke, everything is much stupider than my attempts to parody it” Bloomberg Opinion, Money Stuff, November 16, 2022

New Address

149 Spring Street, 4th Floor, New York, NY 10012

(212) 584-1900

© 2025 SATOVSKY ASSET MANAGEMENT | PRIVACY POLICY | FORM CRS | TERMS OF USE/DISCLAIMERS

NOT FDIC INSURED. NOT BANK GUARANTEED | MAY LOSE VALUE, INCLUDING LOSS OF PRINCIPAL | NOT INSURED BY ANY STATE OR FEDERAL AGENCY

Don’t miss a beat – Sign up to have the latest investor insights, mindfulness tips and market news from our blog delivered right to you.