This week on the blog, Jonathan Satovsky analyzes how elections affect investing by looking at historical market volatility during previous elections and discusses whether you should invest during the election year.

Good afternoon. This is Jonathan Satovsky of Satovsky Asset Management.

On this episode of Seeking Wisdom, Wealth and Wellness we are going to talk about the elections.

People are all a little anxious about the elections worrying, “well, let me wait to make any decision.” [They are putting off] investment decisions, whether to save or invest, until after the election because everyone knows that it’s going to be volatile and uncertain, and it’s not a good time to make decisions.

Well, let’s go to the facts.

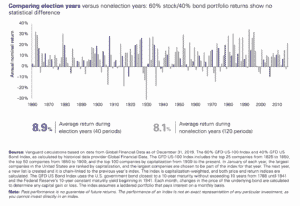

The facts are, as a recent study from Vanguard has shown, analyzing a 60-40 portfolio, 60% stocks and 40% bonds going all the way back 160 years:

[Within this period] there is 40 election years and 120 non-election years. During the 40 election years, the markets averaged 8.9% – with the 60-40 blend – and during the 120 non-election years, the markets averaged 8.1%.

So contrary to people’s feelings, the facts are that people have better investment climates during election years.

Now let’s look at volatility, things being uncertain.

Well everyday’s uncertain. Today I woke up it was chilly and I had to put on a coat; the sun is shining but it’s still 50 degrees rather than 70 or 80 degrees. So you adjust to the climate.

The historical volatility of the S&P 500, as measured by standard deviation is 15.7%.

Amazingly, a hundred days before the election and a hundred days after the election, volatility has been 13.8%, which is less than every other period.

So, contrary to people’s feelings of the uncertainty and the anxiety of worrying about what’s next, the reality and the facts are it’s a better time to invest. Volatility is less, and the conditions are such that everyone is iron clad focused on creating a better future.

So you do the same – adjust, and get into disciplined systematic habits on your journey of seeking your own wisdom, wealth and wellness.

Have a great day.