StarKist or Bumble Bee? | Wisdom, Wealth, and Wellness

StarKist or Bumble Bee? | Wisdom, Wealth, and Wellness

Good morning, good afternoon, good evening. Depending on the part of the world you’re in. This is Jonathan Satovsky of Satovsky Asset Management and on today’s episode of “Seeking Wisdom, Wealth, and Wellness,” I want to talk about saving and investing for the long-term, particularly when times are scary.

The concept of dollar-cost averaging is that you’re buying every month, every week, at varying prices. You don’t know that today the price is high, the price is low, you don’t know, you’re not going to know. Prices, like the weather, are going to change day to day, week to week. But the process of investing and staying consistent even when times are tough, with a philosophy and a discipline that you understand, that makes sense, that you can do sustainably, every time prices fall–if you’re systematically saving, it’s like mana from heaven. You’re actually getting more.

It’s like the analogy of tuna fish. I can buy StarKist or Bumble Bee. Well, if I didn’t discern the taste difference between Bumble Bee and StarKist, and the latter was three for a dollar, why wouldn’t I take more StarKist this week? It’s just not the same for the mind. People can’t relate to the same mindset when they’re viewing their investments.

So think of tuna when you’re thinking about your investing process and stick to the plan. Stick to the path, systematically, regardless of whether prices are high or low. That’s on the accumulation. On the decumulation side it’s a little bit trickier for sure because the pleasure-pain principle is a dollar to every two and a half dollars of pleasure-pain but we’ll cover that in another section. Today, just keep on your path, save, be disciplined in a process and a philosophy that makes sense, that’s sustainable for multiple generations.

Have a great day.

Get the Latest Wealth Insights, Delivered.

Disclosures

This blog post is not intended to be, nor should it be construed or used as, an offer to sell, or a solicitation or offer to buy any securities or interests in any strategy offered by Satovsky Asset Management, LLC (“SAM”). SAM is a registered investment advisor with the Securities and Exchange Commission – for more information see www.adviserinfo.sec.gov. Please remember that different types of investments involve varying degrees of risk, and that past performance is not indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the strategies recommended or undertaken by SAM) will be profitable. Market index information shown herein is included to show relative market performance for the periods indicated and not as standards of comparison. The market volatility, liquidity and other characteristics of SAM’s portfolio composition are materially different from the securities listed on public market indices. Market index information was compiled from sources that SAM believes to be reliable. No representation of guarantee is made hereby with respect of the accuracy or completeness or such data. Opinions are as of date of video and are subject to change. A copy of SAM’s current written disclosure statement discussing our advisory services and fees continues to remain available for your review upon request. SAM undertakes no duty to update information presented herein.

Further Reading

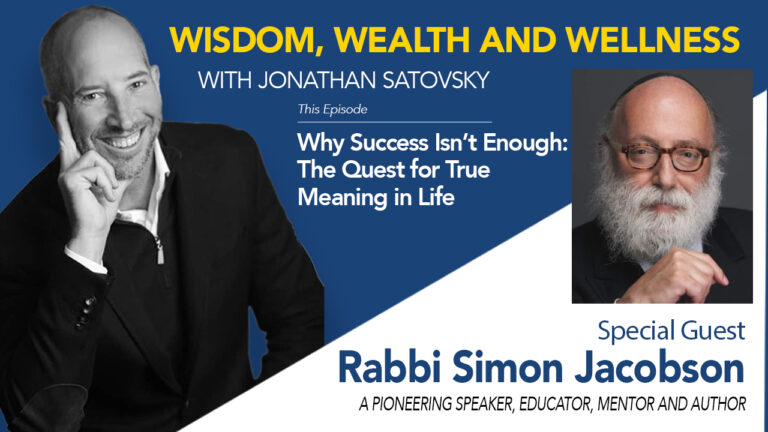

Jonathan Satovsky Interviews Rabbi Simon Jacobson

Always on the run

Learning something new